In the current fast-paced financial earth, Forex trading has emerged as you of the very most dynamic and accessible kinds of investment. Short for “foreign trade,” Forex Trading requires the change of just one currency for yet another with the goal of getting a profit. Functioning 24 hours a day, five days per week, the global Forex market is the biggest and most fluid economic market in the world.

At their core, Forex trading is driven by world wide economic signs, political functions, market sentiment, and key bank policies. Traders analyze these factors to anticipate currency actions and take roles accordingly. Whether getting or offering currency couples, successful trading requires not merely knowledge but additionally control, persistence, and a well-thought-out strategy.

Knowledge the Essentials

In Forex trading, currencies are cited in pairs—such as EUR/USD or GBP/JPY. The initial currency is the “foundation,” and the second is the “quote.” Each time a trader buys a currency set, they're getting the bottom currency and offering the estimate currency. Gains are understood when the worthiness of the base currency increases relative to the quote.

Control is still another essential element in Forex trading, enabling traders to regulate large roles with a comparatively little investment. While leverage may boost increases, in addition it raises the danger, creating risk administration a vital skill for anyone active in the market.

Developing a Trading Approach

An expert approach to Forex trading begins with a great trading plan. This includes setting sensible economic objectives, distinguishing the proper trading model (such as time trading, swing trading, or long-term investing), and selecting suitable currency couples to concentrate on. Traders frequently count on both technical and basic analysis to produce knowledgeable decisions.

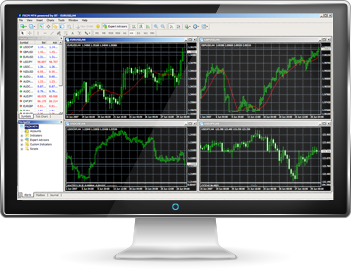

Complex analysis involves understanding cost maps, designs, and indicators to predict future activities, while basic analysis talks about financial data, fascination prices, and geopolitical events. Combining these methods usually effects in a more extensive view of the market.

Risk Administration and Control

Successful chance management is vital to long-term success in Forex trading. This includes setting stop-loss and take-profit degrees, preventing over-leveraging, and only endangering a tiny proportion of capital per trade. Emotional control also represents an important role—traders must fight the temptation to chase deficits or act impulsively.

Applying demo accounts is a proposed first faltering step for beginners. These allow users to practice in real-time industry situations without endangering genuine income, supporting them improve their abilities before transitioning to call home trading.

Realization

Forex trading offers vast possibilities, but inaddition it needs a specialist mind-set and strategic discipline. With an emphasis on training, risk administration, and constant learning, traders may steer the difficulties of the foreign change industry with larger confidence. Whilst the economic earth remains to evolve, Forex remains a valuable market for those seeking development, freedom, and worldwide industry exposure.